avtoelektrik48.ru Overview

Overview

Make Software Without Coding

This is the ultimate guide to create a mobile application without writing code. It covers everything you need to know about this process. The internet's leading educational media site in no-code – helping anyone solve technical problems and build software without code. Glide makes it easy to build and deploy powerful custom apps powered by AI with no code. Create your first app by trying Glide for free. No need to hire a developer. It's easy to use white-label app software to create an app without coding. By Mighty Team. April 17, 6 min read. Take a look at the top 7 free apps that are on the market for someone from a non-technical background who's looking to build their own app. Appy Pie is a platform that allows users to create apps without coding knowledge, offering a range of features and customer support. Reviewers frequently. You don't need a coding background to build an application. Here's how to build an app startup, completely code-free. · 1. Know Your Audience · 2. Define Your. Easily build free, fully-custom no-code apps for iOS, Android or the Web with Adalo's drag and drop platform. Publish directly to the App Store. Jotform Apps is a no-code app maker enabling you to build your own online mobile app without coding. Discover it now, turn your app concept into reality! This is the ultimate guide to create a mobile application without writing code. It covers everything you need to know about this process. The internet's leading educational media site in no-code – helping anyone solve technical problems and build software without code. Glide makes it easy to build and deploy powerful custom apps powered by AI with no code. Create your first app by trying Glide for free. No need to hire a developer. It's easy to use white-label app software to create an app without coding. By Mighty Team. April 17, 6 min read. Take a look at the top 7 free apps that are on the market for someone from a non-technical background who's looking to build their own app. Appy Pie is a platform that allows users to create apps without coding knowledge, offering a range of features and customer support. Reviewers frequently. You don't need a coding background to build an application. Here's how to build an app startup, completely code-free. · 1. Know Your Audience · 2. Define Your. Easily build free, fully-custom no-code apps for iOS, Android or the Web with Adalo's drag and drop platform. Publish directly to the App Store. Jotform Apps is a no-code app maker enabling you to build your own online mobile app without coding. Discover it now, turn your app concept into reality!

In this guide, we cover the different ways a small or medium-sized business can create its own app for employees or customers (or both) without the need for. Build native mobile apps for iOS and Android with no coding background, simply drag and drop your features and create your app with no development costs! How to make an app without coding? · Appy Pie: Known for its simplicity and versatility, Appy Pie offers a range of templates for various types. Top 5 No-Code platforms · Softr · Bubble · Glide · FlutterFlow · Adalo. Adalo specializes in mobile app creation, providing a user-friendly interface and a wide. No coding required. Bubble has all the building blocks you need to create high-performing AI-powered apps without typing a single line of code. Vendor lock-in means that you can potentially be forced to pay a higher price for an inferior bit of software. No-code platforms regularly change their pricing. Appy Pie's App Builder is a user-friendly no-code platform that lets you create mobile apps without any coding. Simply choose a template, customize it with your. And yes, robust no-code backend platforms are here too, making it possible to build a complete app, no coding needed. Chasing The Hobby. So. No-code development is an approach that allows nontechnical users (often called citizen developers) to design websites, applications, and other digital. Thunkable is the most powerful mobile app development platform that allows anyone to create an app without needing to know how to code. We build a wide range of Android and iOS apps for you with our AI-powered mobile app builder. Save development time - Fully managed service from kick off to. No-code mobile app builder for easy DIY app development. Get started with the AppMySite app maker for free and create native Android and iOS apps in minutes. Google Cloud's AppSheet is a no-code app development platform—allowing you to quickly build mobile and desktop apps with your existing data. avtoelektrik48.ru is a ready-to-use solution for those who want how to create an Android app without coding. Our app builder automatically constructs different. No-code development allows technical-minded business professionals to create powerful, cost-effective applications using a visual interface instead of writing. No-code is a software development approach that requires few, if any, programming skills to quickly build an application, website or module that links into an. Imagine being able to develop software without having to leverage coding skills in a fast-paced digital environment where time is of the essence. In no-code app builders, you can create your apps without needing to code a single line. Apps created with no-code app builders are easy to make. There is something known as NoCode in which you do the stuff you can using code but without actually coding anything. · Do check out stuff like.

Best Professional Liability Insurance For Consultants

Professional liability is also sometimes called professional indemnity insurance or errors & omissions coverage. How does professional liability insurance work? At Heffernan Insurance, we ensure your professional practice is protected - from the consulting engineer to the managing principal in a large architecture. Consulting insurance protects independent consultants and consulting businesses from financial losses caused by claims of negligence, injuries and other. Professional liability insurance, also known as errors and omissions insurance, helps protect your business if you are sued for negligence in the performance of. On the other hand, businesses that provide more guidance-based services, such as accountants and business consultants, often refer to this coverage as “errors. On the other hand, businesses that provide more guidance-based services, such as accountants and business consultants, often refer to this coverage as “errors. Professional liability insurance is coverage that protects business professionals, such as attorneys, consultants and accountants, from claims of negligence or. In the UK and Australia, it's referred to as professional indemnity insurance. This type of insurance covers business owners against claims of: Alleged or. Professional liability insurance is coverage that protects business professionals, such as attorneys, consultants and accountants, from claims of negligence or. Professional liability is also sometimes called professional indemnity insurance or errors & omissions coverage. How does professional liability insurance work? At Heffernan Insurance, we ensure your professional practice is protected - from the consulting engineer to the managing principal in a large architecture. Consulting insurance protects independent consultants and consulting businesses from financial losses caused by claims of negligence, injuries and other. Professional liability insurance, also known as errors and omissions insurance, helps protect your business if you are sued for negligence in the performance of. On the other hand, businesses that provide more guidance-based services, such as accountants and business consultants, often refer to this coverage as “errors. On the other hand, businesses that provide more guidance-based services, such as accountants and business consultants, often refer to this coverage as “errors. Professional liability insurance is coverage that protects business professionals, such as attorneys, consultants and accountants, from claims of negligence or. In the UK and Australia, it's referred to as professional indemnity insurance. This type of insurance covers business owners against claims of: Alleged or. Professional liability insurance is coverage that protects business professionals, such as attorneys, consultants and accountants, from claims of negligence or.

Chubb's tailored professional liability and E&O insurance solutions are designed to provide the protection you need in today's business climate. Video Play icon. One size does not fit all. Especially with professional liability insurance. ASCE's expanded program includes higher limits and broader coverage. Professional liability insurance, or errors and omissions insurance, is one of the most important coverages for consultants to carry. At its core, it protects. Coverages: Liberty Mutual offers common types of insurance policies for small businesses, including commercial property, professional liability, workers'. The Hartford: Best overall provider for professional liability insurance; Next Insurance: Best for contractors and instant certificates of insurance (COIs). Chubb's tailored professional liability and E&O insurance solutions are designed to provide the protection you need in today's business climate. Video Play icon. Professional liability insurance is a type of business insurance that protects professionals, including consultants. If a client files a lawsuit over a mistake. The best way to find out what you'll pay is to get a quote customized to your unique business. Basic consulting coverage: Professional Liability. This essential. At Heffernan Insurance, we ensure your professional practice is protected - from the consulting engineer to the managing principal in a large architecture. We provide consulting and advisory professionals with Errors & Omissions (E&O) insurance in the event they find themselves in a lawsuit claiming negligence. Business consultant insurance can protect your small business against claims of negligence, injury and other forms of liability. This consultant could also require general liability insurance to address any claims that may arise from a client's bodily injury on their premises. By. 5-Star Excellence Awards · Admiral Insurance Group · AIG · Allied World Assurance Company Ltd. · AmTrust Financial · Arch Insurance Group Ltd. · Argo · AXA XL · Axis. Professional liability insurance, also known as errors & omissions coverage, provides protection for defense costs and settlement payments for claims that your. Professional liability insurance for consultants (also known as errors and omissions, or E&O) protects you from negligence suits. Even if the claim is. With a variety of policy options for every industry, specialty coverages, and its signature ReputationGuard program, AIG is the best overall professional. Explore Proliability for comprehensive professional liability insurance solutions. Protect your career and assets with customizable coverage options. If things escalate to a lawsuit, professional liability insurance — also frequently referred to as E&O (errors & omissions) coverage or professional indemnity —. The Best Professional Liability Insurance Companies ; 6, State Farm, / ; 7, Zurich, / ; 8, Great American, / ; 9, Philadelphia Insurance. Liability Insurance premiums and assisting employees in decisions about purchasing Professional Liability Insurance best interests of the United States.

Best Generator To Purchase

All of our portable power generators come from Mi-TM Corporation. These generators are designed to provide electricity on location using a fuel-powered engine. The best-rated product in Portable Generators is the PMDF Watt Recoil Start Gasoline/Propane Dual Fuel Portable Generator with CO-Sense, ST/CSA. Key Features of the Best Generators · Size: Make sure you have enough space to store both the generator and its fuel. · Noise: Some generators, particularly. Harbor Freight delivers unbeatable value in reliable and quiet gasoline and inverter generators. We carry everything from watt generators perfect for. When the question "What size generator do I need?" comes up, this guide will help you choose the best generator size for you. SHOP GENERATORS NOW. Jump to. What Kind of Generator Do I Need · Gasoline provides the most power. · Propane runs cleaner and stores longer, but produces less power · Natural Gas equates to a. The Best Standby Generators · Best Home Standby Generator: Generac Guardian · Best Entry-Level Home Standby Generator: Briggs & Stratton Power Protect PP Shop for portable generators at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Top 7 Home Generators · Best Overall: DuroMax Electric-Start Generator · Easiest To Start: Westinghouse Portable Generator · Best Inverter Generator: Champion. All of our portable power generators come from Mi-TM Corporation. These generators are designed to provide electricity on location using a fuel-powered engine. The best-rated product in Portable Generators is the PMDF Watt Recoil Start Gasoline/Propane Dual Fuel Portable Generator with CO-Sense, ST/CSA. Key Features of the Best Generators · Size: Make sure you have enough space to store both the generator and its fuel. · Noise: Some generators, particularly. Harbor Freight delivers unbeatable value in reliable and quiet gasoline and inverter generators. We carry everything from watt generators perfect for. When the question "What size generator do I need?" comes up, this guide will help you choose the best generator size for you. SHOP GENERATORS NOW. Jump to. What Kind of Generator Do I Need · Gasoline provides the most power. · Propane runs cleaner and stores longer, but produces less power · Natural Gas equates to a. The Best Standby Generators · Best Home Standby Generator: Generac Guardian · Best Entry-Level Home Standby Generator: Briggs & Stratton Power Protect PP Shop for portable generators at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Top 7 Home Generators · Best Overall: DuroMax Electric-Start Generator · Easiest To Start: Westinghouse Portable Generator · Best Inverter Generator: Champion.

If you're searching for a high-quality diesel or gasoline generator for home use, then an SGS generator will be ideal. Designed to be run occasionally, they are. We use our buying authority to negotiate the best value in the marketplace Yoshino K40SP22 W Solid-State Portable Solar Generator Pro with 2-piece W. 6 Best Home Generators of for Reliable Energy ; Best Overall: Briggs and Stratton PowerProtect 26kW Home Standby Generator ; Best Budget: Wen GNX. Best Overall: Briggs and Stratton PowerProtect 26kW Home Standby Generator ; Best Budget: Wen GNX Generator ; Best for Standby Power: Generac Guardian 24kW. Customer Favorites · Champion Power Equipment Watt RV Ready Portable Generator with CO Shield (CARB) · Champion Power Equipment Champion Watt Portable. If it has to be portable gasoline powered, buy Honda or Yamaha, and buy I too have been shopping for a larger diesel generator (5 or 10 KW MEP Revered as one of the best generator brands to buy, Generac literally created the home backup generator category. Today, Generac generators are preferred by 7. Home Generators - Diesel Powered for less noise, highest reliability, longest life, and lower cost of installation. Aurora builds the most reliable. Best Buy. Brand Briggs & Stratton Briggs & Stratton StormResponder Watt Portable Generator Rubber | price. Kohler is one of the best brands as they are known to produce the best quality that are both durable and reliable. These generators are designed for long-term. Westinghouse Watt Dual Fuel Home Backup Portable Generator, Remote Electric Start, Transfer Switch Ready, Gas and Propane Powered. Kohler Generators are the most popular brand at FPS in terms of numbers sold. Kohler appears at the top of the list in generator ratings reviews. These. The standby generators with the most power output are called whole-house generators because they could theoretically power your entire home if sized properly. Limited time sale on these generators. From home backup to jobsite and outdoor use, these generators will handle everything you throw at them. Among people considering purchasing portable generators, Honda was the most trusted brand, according to Lifestory Research's America's Most Trusted®. Diesel: Most standby generators run on diesel. This fuel type is readily available and known for reliability, with a fast kick-on time. Companies concerned. This varies however, and your best bet is to check the manual of the device you're planning to power for an exact value. At the bottom of this guide is a list. If your budget has no limit then id say the Honda EB is probably the "best" in that cathegory. Otherwise, Westinghouse and Champion have. Best Sellers in Generators · #1. Firman Hybrid Watt Dual Fuel (Gasoline/Propane) Portable Generator #H · #2. Firman Hybrid Watt Dual Fuel (Gasoline. A Generac standby generator protects your home and gives you peace of mind. When the power fails, you'll be ready. With automatic operation and 24/7/

Do Banks Require Home Inspections

Home inspections usually aren't required for a mortgage loan. They're optional, meaning it's up to the buyer to request one (and pay for it). An inspection can. Buyers Home Inspection. Buying a home? Always get a real estate inspection first. Most banks require at least a pest inspection, and many require a full. Lenders today do not require inspections. The only exceptions would be VA loans, which require a termite inspection and clearance, and FHA loans. If a client is banking on the “certification” to be the deciding factor on which Inspector to choose, then they should do due diligence to find out who has. While a home inspection is necessary when buying a home, mortgage lenders generally don't require one. In most cases, they'll only ask for a wood-destroying. A home appraisal is an estimate of a home's fair market value performed by a licensed appraiser. Mortgage lenders often require an appraisal before they'll. Home inspections are generally not required in New Jersey, but highly recommended. Appraisals, on the other hand, are required when a buyer is using a mortgage. Yes! Mortgage lenders and your real estate agent should encourage that a home inspection is necessary before purchasing a new home. An appraisal is almost always required by a lender before final loan approval. Lenders want to ensure the amount you're asking to borrow makes sense. If there. Home inspections usually aren't required for a mortgage loan. They're optional, meaning it's up to the buyer to request one (and pay for it). An inspection can. Buyers Home Inspection. Buying a home? Always get a real estate inspection first. Most banks require at least a pest inspection, and many require a full. Lenders today do not require inspections. The only exceptions would be VA loans, which require a termite inspection and clearance, and FHA loans. If a client is banking on the “certification” to be the deciding factor on which Inspector to choose, then they should do due diligence to find out who has. While a home inspection is necessary when buying a home, mortgage lenders generally don't require one. In most cases, they'll only ask for a wood-destroying. A home appraisal is an estimate of a home's fair market value performed by a licensed appraiser. Mortgage lenders often require an appraisal before they'll. Home inspections are generally not required in New Jersey, but highly recommended. Appraisals, on the other hand, are required when a buyer is using a mortgage. Yes! Mortgage lenders and your real estate agent should encourage that a home inspection is necessary before purchasing a new home. An appraisal is almost always required by a lender before final loan approval. Lenders want to ensure the amount you're asking to borrow makes sense. If there.

The bank appraiser is also looking for visible safety concerns in the home, such as missing handrails and peeling paint, but will not be as detailed as an. Licensed home inspectors can get a piece of this market by partnering with banks to fulfill all their home-inspection needs. Lending institutions also find they require Occupancy Verification Inspections when they are foreclosing a property. Essentially, banks need to ensure that. The WDI inspection is for the bank's convenience, so as long as someone puts down on paper that the home does not have termite damage or infestation, the bank. And when you read your loan documents, you'll also see that they have the right to inspect it and make sure you're maintaining it until you pay. Lenders usually don't require a home inspection because the home appraisal tells them what they need to know. In other words, lenders want to protect their investment, as well as yours. For this reason, most banks require a home inspection (often with their own. When Do I Need A Mortgage Loan Inspection? Mortgage loan inspections are typically required by lenders and title attorneys as part of the process of closing. As soon as a mortgager fails to make their regular payment to the bank, the bank sends an occupancy inspector to see if the property has become vacant or if it. Lenders and mortgage brokers are required by federal law, the Real Estate Settlement Procedures Act (“RESPA”), to give you this information. You should receive. Appraisals are USUALLY required, and there are different checklists for those homes depending on what type of financing you are using. The most. Lenders may require that you have your prospective home inspected by a professional before they approve your mortgage. Even if they don't, hiring an inspector. A home inspection is typically performed after an accepted offer to purchase has been signed. A specified time frame typically is written into the contract in. The servicer must inspect a property as soon as possible after it becomes aware of the possibility that the property may be vacant or abandoned. When the. Lenders want to ensure that the property is in good condition to protect their investment. Additionally, home inspections allow buyers to make informed. A thorough inspection is a critical step in purchasing a home, and many lenders won't offer financing on a home without one. Home inspectors look at the. Under normal conditions, the buyer is usually the one that pays for the home inspection. But if it comes down to losing or closing a sale, sometimes the seller. How do I request a home inspection, and who will pay for it? Should I be present when the home inspection is performed? Are all inspection reports the same? How. Lenders do not require home inspections. It is voluntary for the buyers to have an inspection done. However, it is highly recommended. Home inspections are done. We provide property inspections for banks and other clients. Banks are required to check on their properties for insurance purposes, during refinancing.

How To Determine Your Retirement Tax Bracket

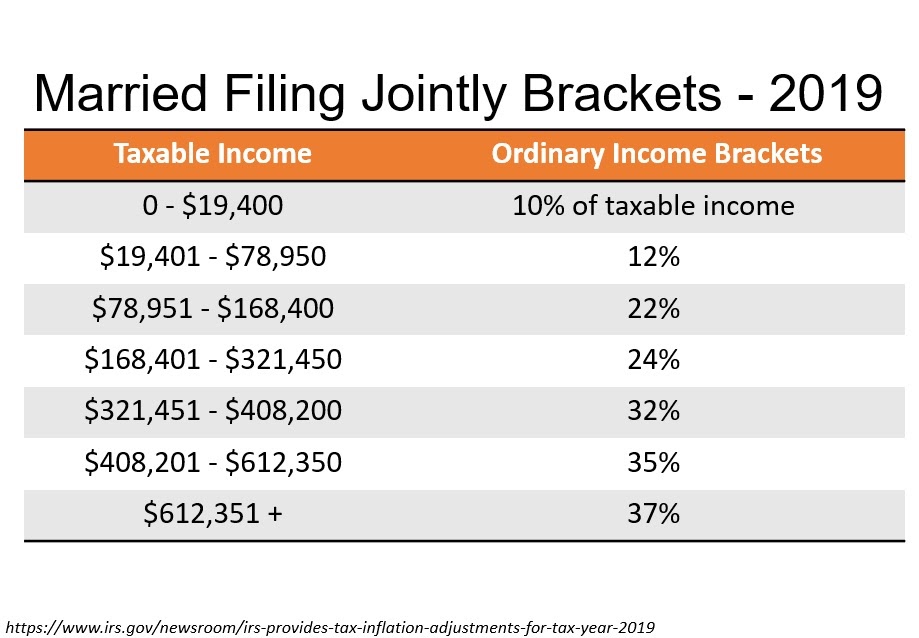

Your income is a primary driver of tax brackets. In general, the higher your income, the higher your tax bracket. However, you figure self-employment tax (SE tax) yourself using Schedule SE (Form or SR). Also, you can deduct the employer-equivalent portion of your. Your tax bracket in retirement is simply whatever you need to pull for spending, or what you are forced to pull by SS and RMDs. Tax brackets. Generally speaking, retirees' taxable income sources will fall under one of two federal tax categories: Ordinary income, which is taxed from 10% to 37% and. Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans (IRS Sec. ). The future value will depend on what your tax bracket is before and after you retire. Try to estimate which one best reflects your present and future tax. This calculator helps you estimate your average tax rate, your tax bracket, and your marginal tax rate for the current tax year. tax brackets and federal income tax rates ; 10%, $0 to $11,, $0 to $22, ; 12%, $11, to $44,, $22, to $89, ; 22%, $44, to $95,, $89, A retirement withdrawal strategy that places you in the lowest possible tax bracket can help you manage the impact of taxes. A key part of planning for. Your income is a primary driver of tax brackets. In general, the higher your income, the higher your tax bracket. However, you figure self-employment tax (SE tax) yourself using Schedule SE (Form or SR). Also, you can deduct the employer-equivalent portion of your. Your tax bracket in retirement is simply whatever you need to pull for spending, or what you are forced to pull by SS and RMDs. Tax brackets. Generally speaking, retirees' taxable income sources will fall under one of two federal tax categories: Ordinary income, which is taxed from 10% to 37% and. Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans (IRS Sec. ). The future value will depend on what your tax bracket is before and after you retire. Try to estimate which one best reflects your present and future tax. This calculator helps you estimate your average tax rate, your tax bracket, and your marginal tax rate for the current tax year. tax brackets and federal income tax rates ; 10%, $0 to $11,, $0 to $22, ; 12%, $11, to $44,, $22, to $89, ; 22%, $44, to $95,, $89, A retirement withdrawal strategy that places you in the lowest possible tax bracket can help you manage the impact of taxes. A key part of planning for.

A retired couple filing jointly could have $, in regular income and, after taking the $24, standard deduction, still fall within the 15% tax bracket. NOTE: For tax year (January 1, – December 31, ; due April 18, ), retirees must calculate their allowable retirement subtraction using the Tier. As soon as their income exceeds $41,, they are taxed at 22%. Effective tax planning is essential up to and throughout retirement. Countless taxpayers who get. So if you earn $75, from your salary job, but earn $25, a year in pension or other income, then you will move up a tax bracket. You will then earn a total. Retirement tax rates by income source Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. Long-term. Division VI of that legislation excludes retirement income from Iowa taxable income for eligible taxpayers for tax years beginning on or after January 1, The Internal Revenue Service (IRS) adjusts tax brackets on an annual basis, changing the amount of income that gets taxed at each rate. This means the amount of. You should use your average tax rate when estimating your total tax liability for a year. For example, if you are planning your retirement and wish to estimate. Tax Deductions, Exemptions, and Credits · Exemption for Social Security Benefits · Exemption for Civil Service Retirement System (CSRS) · Exemption for Other. Your filing status determines the income levels for your Federal tax rates. your ordinary income tax bracket is a lower rate). Long-term Capital Gain. This can range from 50 to 85 percent depending on your income. There is no tax break at all if you're married and file separate returns. The IRS also provides. In actuality, income is taxed in tiers. When your income reaches a different tier, that portion of your income is taxed at a new rate. Your marginal tax rate or. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. At a 25% tax rate, in order to contribute $75 they must earn $ $25 will be paid in taxes and the remaining $75 contributed to the Roth IRA. At retirement. If you're in a lower income tax bracket when you retire, you may be taxed at Be sure to talk to your tax preparer to determine whether this strategy makes. The tax rate or taxable amount of some income sources, such as Social Security, may differ and your personal tax rate may vary. We recommend you consult a. Generally, your withholding is tied to the retirement system. So, if your benefits are from the same system, you only need to submit your withholding. State Taxes: Unless you specify a monthly withholding rate or amount for state taxes, your pension account will default to the rate of "single" with zero. That consists of your adjusted gross income, plus any nontaxable interest you earned (and certain other items) and half of your Social Security income. The. The bracket you fall into is determined by your filing status and taxable income (income minus deductions). Common sources of retirement income that are taxable.

Indirect Rollover From 401k To Ira

You may directly transfer assets between investment firms as frequently as you wish. The second, less common approach is called An indirect rollover. Rollovers. Direct rollover: With a direct rollover, your (k) plan administrator sends the funds directly to your new IRA custodian. This is often the easiest and most. For indirect rollovers: · The (k) plan administrator will send you Form R. · Use the values reported on your R on your personal tax return via Form. An indirect rollover occurs when your plan administrator or financial institution issues a check payable to you, you cash the check, and you then transfer the. An indirect rollover is a payment from a retirement account to the investor for later deposit in a new account. It can be a very costly mistake. If you take possession of those funds and then decide to redeposit into a Robinhood IRA, this would be considered an indirect rollover. You'll need to ensure. Key Takeaways · The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. You may directly transfer assets between investment firms as frequently as you wish. The second, less common approach is called An indirect rollover. Rollovers. Direct rollover: With a direct rollover, your (k) plan administrator sends the funds directly to your new IRA custodian. This is often the easiest and most. For indirect rollovers: · The (k) plan administrator will send you Form R. · Use the values reported on your R on your personal tax return via Form. An indirect rollover occurs when your plan administrator or financial institution issues a check payable to you, you cash the check, and you then transfer the. An indirect rollover is a payment from a retirement account to the investor for later deposit in a new account. It can be a very costly mistake. If you take possession of those funds and then decide to redeposit into a Robinhood IRA, this would be considered an indirect rollover. You'll need to ensure. Key Takeaways · The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free.

If you've done an indirect rollover, your custodian will send you a form R documenting the amount that was distributed from your retirement plan. Any. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Moving money from your (k) plan to an IRA, is considered a rollover. A Roth conversion occurs when you move money from a traditional IRA into a Roth IRA. Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. A direct rollover or an indirect rollover to an IRA will keep your retirement assets tax-deferred. Thrivent Mutual Funds offers simple, flexible options. You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the day rollover. The exception is a rollover to a Roth IRA or in-plan rollover to a designated Roth account, in which case the participant will owe taxes in the year the. While there is no limit to the number of indirect rollovers you can complete between eligible retirement plans or between IRAs and eligible retirement plans. Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer. You then have 60 days to deposit all of the funds into an IRA. If you don't, then you have to pay taxes and penalties. An indirect rollover can cause you to owe. A rollover is when you move funds from one eligible retirement plan to another, such as from a (k) to a Traditional IRA or Roth IRA. Rollover distributions. Yes, you can but it's important to be aware that if you do roll pre-tax (k) funds into a traditional IRA, you may not be able to roll those funds back into. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your. How to Roll Over a Qualified Employer Sponsored Retirement Plan (QRP) Such as (k), (b), or Governmental (b) into an IRA · Step 1 – Choose an IRAExpand. You can transfer a (k) to an IRA if you have left a job. First, open or establish an IRA at IRAR and complete our Rollover Certification Form. Then, contact. An indirect rollover occurs when your plan issues a check payable directly to you and you roll over the money to an IRA within 60 days. With an indirect. You can roll over your traditional (k) or (b) into a Roth IRA, but this will be considered a Roth conversion which is a taxable event I want to. If you take possession of those funds and then decide to redeposit into a Robinhood IRA, this would be considered an indirect rollover. You'll need to ensure. If you choose to rollover the (k), your funds are invested in an IRA account which offers you full control of your savings and investments. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account.

Youtube Marketing Courses

Courses for managed Music, Enterprise, Media partners and Content ID partners. About Course · What You'll Learn · Course Plan · Introduction · Channel Optimization · How to create professional videos for your channel · How to SEO · Video. Digital Marketing for Beginners: Everything You Need To Know ; Top Digital Marketing Strategies Business Owners NEED to Know · 38K views ; How Inbound Marketing. Trending courses · Social Media Marketing: Strategy and Optimization · Social Media Promotion for Musicians, Artists, and Engineers · YouTube Tips Weekly · Learning. Unlock creativity & fast video results with expert-led training. Learn marketing, script writing, studio design & more in courses & workshops. Course Objectives · Recognise the prevalence of video in social media and its importance as a marketing medium for businesses · Create SMART video marketing. YouTube Certified is a series of courses designed to help eligible creators and partners use advanced YouTube systems and tools. Check if you're eligible. Video Marketing (YouTube) CourseOnline TrainingENQUIRE NOWMake Your YouTube Videos Rank BetterYouTube is the biggest search engine outside of the core. In this free Youtube Marketing course, we are going to cover the basics of the topic, mastering storytelling and marketing strategies. Courses for managed Music, Enterprise, Media partners and Content ID partners. About Course · What You'll Learn · Course Plan · Introduction · Channel Optimization · How to create professional videos for your channel · How to SEO · Video. Digital Marketing for Beginners: Everything You Need To Know ; Top Digital Marketing Strategies Business Owners NEED to Know · 38K views ; How Inbound Marketing. Trending courses · Social Media Marketing: Strategy and Optimization · Social Media Promotion for Musicians, Artists, and Engineers · YouTube Tips Weekly · Learning. Unlock creativity & fast video results with expert-led training. Learn marketing, script writing, studio design & more in courses & workshops. Course Objectives · Recognise the prevalence of video in social media and its importance as a marketing medium for businesses · Create SMART video marketing. YouTube Certified is a series of courses designed to help eligible creators and partners use advanced YouTube systems and tools. Check if you're eligible. Video Marketing (YouTube) CourseOnline TrainingENQUIRE NOWMake Your YouTube Videos Rank BetterYouTube is the biggest search engine outside of the core. In this free Youtube Marketing course, we are going to cover the basics of the topic, mastering storytelling and marketing strategies.

Learn step-by-step · Create a YouTube channel · Customize your YouTube channel · Post videos · Increase your reach · Interact with customers · Use the Analytics. Designed for both beginners and experienced marketers, this course covers everything from setting up your channel to mastering advanced marketing strategies. A course by. MD Yasin Arafat Nov/ 0 lessions English Description Curriculum Instructor YouTube Marketing % positive reviews 7 students. We will give you a brief guide, including the Top 7 steps to successfully promote and sell your online course on YouTube. Learn key video marketing skills, from content creation to efficient promotion and reporting, in HubSpot Academy's Video Marketing course! EduCert Global Digital Marketing Institute in Lucknow provides all the tools, instruction and support you need to become a successful Digital Marketer. Their. Learn about YouTube video marketing and how to generate a free targeted traffic from this free online Youtube Marketing course. YouTube Marketing Course; Learn how to grow your business or personal channel on YouTube while hitting 5K subscriber in 3 months time. Boost your YouTube growth with Great Learning's free marketing course. Learn SEO, effective strategies, and storytelling. Get certified and start for free. This playlist contains a comprehensive course on YouTube marketing, covering everything from creating a successful channel to optimizing your videos for search. Get more with paid YouTube Marketing courses · YouTube Marketing YouTube SEO & Algorithms · YouTube Masterclass: Your Guide to YouTube Success · The. Learning Outcomes · Set up a business YouTube channel · Understand the process of using YouTube video to drive social engagement · Develop basic video content. This two-day course will allow you to create a YouTube video marketing strategy, launch your strategy, and manage your YouTube channel. Video Marketing (YouTube) CourseOnline TrainingENQUIRE NOWMake Your YouTube "Within 6 weeks of taking one of Darren's online courses we increased room. Learn YouTube Marketing in Domestika, the largest community of creatives. Improve your skills with online courses taught by leading professionals. These free Youtube marketing courses are collected from udemy with off coupons and available for free. Get free udemy courses download not require. Find the. Whether you're an aspiring content creator, marketer, or entrepreneur, this course will help you master the art of video content creation and marketing. Learn in Real-Time with Small Class Sizes. Attend this course in-person in NYC or Live Online via Zoom. Engage with expert instructors, ask questions, and get. This video training course shows you how to drive more traffic to your site and more customers to your business by getting your videos to rank higher on.

Local Government Bond

:max_bytes(150000):strip_icc()/government-bond.asp-final-06b10b01401d4b5e92224e885750ea63.png)

A government bond is issued at the federal, state, or local level to raise debt capital. GO bonds give cities a tool to raise funds for capital improvement projects that are otherwise not funded by City revenue, such as roads, bridges, bikeways and. Most municipal bonds are fixed-rate bonds, meaning they pay a fixed rate of interest until maturity or earlier if the bonds are redeemed prior to maturity. In May, the issuance of local government bonds (LGBs) were RMB billion, with a month-on-month increase of RMB billion and a year-on-year decrease. Generally, when enough time passes and the call date approaches, the government will assess current market rates at that time, and if current market rates are. Most bonds issued by government agencies are tax-exempt. This means interest on these bonds are excluded from gross income for federal tax purposes. In addition. State and local governments issue bonds to pay for large, expensive, and long-lived capital projects, such as roads, bridges, airports, schools, hospitals. Tax-exempt bonds are the primary mechanism through which state and local governments raise capital to finance a wide range of essential public projects. The. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source. A government bond is issued at the federal, state, or local level to raise debt capital. GO bonds give cities a tool to raise funds for capital improvement projects that are otherwise not funded by City revenue, such as roads, bridges, bikeways and. Most municipal bonds are fixed-rate bonds, meaning they pay a fixed rate of interest until maturity or earlier if the bonds are redeemed prior to maturity. In May, the issuance of local government bonds (LGBs) were RMB billion, with a month-on-month increase of RMB billion and a year-on-year decrease. Generally, when enough time passes and the call date approaches, the government will assess current market rates at that time, and if current market rates are. Most bonds issued by government agencies are tax-exempt. This means interest on these bonds are excluded from gross income for federal tax purposes. In addition. State and local governments issue bonds to pay for large, expensive, and long-lived capital projects, such as roads, bridges, airports, schools, hospitals. Tax-exempt bonds are the primary mechanism through which state and local governments raise capital to finance a wide range of essential public projects. The. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source.

A municipal bond is a type of debt instrument issued by nearly 42, state or local governments (or governmental entities, such as water and sewer districts or. A municipal bond is a type of debt instrument issued by nearly 42, state or local governments (or governmental entities, such as water and sewer districts or. State and local governments receive direct and indirect tax benefits under the IRC that lower borrowing costs on their valid debt obligations. Because interest. The local government bond market in China has grown rapidly in recent years and is now. China's largest bond market (Graph A1). It is. Municipal bonds are debt obligations issued by public entities that use the loans to fund public projects such as the construction of schools, hospitals. 86 Local Government Bonds Amendments. Bill Text; Status; Hearings/Debate. Bill Before issuing an applicable lease revenue bond on or after May 1, , a. The MDAC debt database collects data on Oregon local government loans to enhance transparency, generate more accurate overlapping debt reports, and provide. Local Government Debt Although the BRB does not play a part in the approval of local government debt issuance, one of the agency's goals is to ensure that. A general purpose local government owner or operator and/or local government serving as a guarantor may satisfy the requirements of § by having a. Debt that is not voter-approved is limited to percent of assessed valuation for all local jurisdiction types. When debt has been approved by three-fifths of. Income from bonds issued by the federal government and its agencies, including Treasury securities, is generally exempt from state and local taxes. (3) "Type of bond" includes: (a) General obligation bonds, including councilmanic and voter-approved bonds; (b) revenue bonds; (c) local improvement district. Municipal bond A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and. Local Government Bonds · Local Government bonds are obligations undertaken by local public entities to raise financing. · Funding sources for Local Government. The Texas BRB Data Center is an informative and educational tool for decision-makers and the general public to learn more about state and local government debt. Even though the voter approval process may be time intensive and costly to mount, California local governments have continued to rely on GO bonds as a financing. Local Governmental Commission approval is needed for certain local government contracts, guidelines for local governments wishing to issue debt, NC General. When local bonds are issuers, two or more local public bodies, on approval of their respetire asseurbies, way issuebonds jointly. Only government bodies or other entities that issue state or local government bonds may buy SLGS. They may buy SLGS only if the proceeds from those state or. Federal State and Local Governments · Indian Tribal Governments · Tax Exempt Buy savings bonds at Treasury Direct. Recent developments. Changes to.

How Do Free Stocks Work

It can borrow the money, but that involves taking on debt and paying it back with interest. Or it can issue shares on a stock exchange or in the private markets. Brokerage accounts hold investments such as stocks, bonds, and mutual funds, which aren't insured by the FDIC. Vanguard accounts are protected by Securities. Robinhood will give you a free stock (value of $5-$) when you sign up for an account and deposit at least $10 into your account. Then, for every friend you. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. So, whether you buy or sell 10 shares or shares, both trades would still be commission-free. WHAT ARE STOCKS AND HOW DO THEY WORK? Stocks represent units. Please keep up with the stock giveaway events in the moomoo app. By participating in these events, you can have a chance to get free stocks. 2. Where can I. I should add that a one cent deposit will grant you 12 free stocks and a deposit over $ will grant 20 free shares $ will grant Instead of buying a whole share of stock, you can buy a fractional share, which is a "slice" of stock that represents a partial share, for as little as $5. For. Getting free stocks is actually quite simple. It's literally free money, and you honestly don't need any prior knowledge of stocks or. It can borrow the money, but that involves taking on debt and paying it back with interest. Or it can issue shares on a stock exchange or in the private markets. Brokerage accounts hold investments such as stocks, bonds, and mutual funds, which aren't insured by the FDIC. Vanguard accounts are protected by Securities. Robinhood will give you a free stock (value of $5-$) when you sign up for an account and deposit at least $10 into your account. Then, for every friend you. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. So, whether you buy or sell 10 shares or shares, both trades would still be commission-free. WHAT ARE STOCKS AND HOW DO THEY WORK? Stocks represent units. Please keep up with the stock giveaway events in the moomoo app. By participating in these events, you can have a chance to get free stocks. 2. Where can I. I should add that a one cent deposit will grant you 12 free stocks and a deposit over $ will grant 20 free shares $ will grant Instead of buying a whole share of stock, you can buy a fractional share, which is a "slice" of stock that represents a partial share, for as little as $5. For. Getting free stocks is actually quite simple. It's literally free money, and you honestly don't need any prior knowledge of stocks or.

Our database covers 3, stock funds available in the U.S.. Step two icon. See your results. We track fund exposure to fossil fuel companies, fossil finance. 'Commission-free' trading or 'commission-free investing' just means the broker doesn't charge you for the service of buying or selling shares. And the benefit. Instead of buying a whole share of stock, you can buy a fractional share, which is a "slice" of stock that represents a partial share, for as little as $5. For. Commission-free online trades apply to trading in U.S. listed stocks, Exchange-Traded Funds (ETFs), and options. Option trades are subject to a $ per-. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. Invest your way, commission-free Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform. Investing is, in itself, risky and sometimes results in heavy losses, but a stock trade app like E-Trade or Robinhood gives one an opportunity to save on extra. Do you actively trade stocks? If so, it's important to know what it means to Firms are free to impose a higher equity requirement than the minimum. A stock that is paid for in full and is not pledged in any way as collateral. DIY investing: If you grasp how stocks work and have the confidence to : These are platforms that enable you to practice trading stocks risk-free using. Free trading refers to $0 commissions for Moomoo Financial Inc. self-directed individual cash or margin brokerage accounts of U.S. residents that trade U.S. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Stocks by the Slice SM makes dollar-based investing easy. Own a slice of your favorite companies and exchange-traded funds (ETFs) for as little as $ Get. TradeUp is a stock app for active traders that allows you to draw free shares valued up to $1, Here's a breakdown of how the rewards work based on your. Once you create your account, Robinhood will give you a free share of stock. The share is chosen randomly and can fluctuate with the stock market. Available via. A stock that is paid for in full and is not pledged in any way as collateral. It can borrow the money, but that involves taking on debt and paying it back with interest. Or it can issue shares on a stock exchange or in the private markets. Service charges apply for trades placed through a broker ($25). Stock plan account transactions are subject to a separate commission schedule. All fees and. Alternative Assets purchased on the Public platform are not held in a Public Investing brokerage account and are self-custodied by the purchaser. The issuers of. We offer a free stock market game featuring real-time stock prices and rankings that allows users to learn about the stock markets and practice investing in.

Hero Moto Corp

Hero MotoCorp Limited primarily engages in the manufacture and sale of motorized two wheelers in India, Asia, Central and Latin America, Africa. What makes Hero MotoCorp the best Motorcycle Company in South Africa. Hero MotoCorp's philosophy is based on 'Be the Future of Mobility' and this not only. Hero Motocorp ltd. The Grand Plaza Plot No.2,Nelson Mandela Road, Vasant Kunj,Phase-II,New Delhi(India). Find company research, competitor information, contact details & financial data for HERO MOTOCORP LIMITED of New Delhi, Delhi. Explore the world of Hero MotoCorp, India's favorite two-wheeler manufacturer. Explore our range of stylish and powerful two-wheelers. Hero MotoCorp Ltd. engages in the manufacture of two wheeler. Its products include Karizma ZMR, Xtreme Sports, Achiever , New Glamour, Super Splendor. Welcome to the official account of Hero MotoCorp - your favourite & the world's largest two-wheeler manufacturer! #MillionHeroes #MadeOfTrust. Hero MotoCorp Limited Share Price Today, Live NSE Stock Price: Get the latest Hero MotoCorp Limited news, company updates, quotes, offers, annual financial. Welcome to the official account of Hero MotoCorp - your favourite & the world's largest two-wheeler manufacturer! Hero MotoCorp Limited primarily engages in the manufacture and sale of motorized two wheelers in India, Asia, Central and Latin America, Africa. What makes Hero MotoCorp the best Motorcycle Company in South Africa. Hero MotoCorp's philosophy is based on 'Be the Future of Mobility' and this not only. Hero Motocorp ltd. The Grand Plaza Plot No.2,Nelson Mandela Road, Vasant Kunj,Phase-II,New Delhi(India). Find company research, competitor information, contact details & financial data for HERO MOTOCORP LIMITED of New Delhi, Delhi. Explore the world of Hero MotoCorp, India's favorite two-wheeler manufacturer. Explore our range of stylish and powerful two-wheelers. Hero MotoCorp Ltd. engages in the manufacture of two wheeler. Its products include Karizma ZMR, Xtreme Sports, Achiever , New Glamour, Super Splendor. Welcome to the official account of Hero MotoCorp - your favourite & the world's largest two-wheeler manufacturer! #MillionHeroes #MadeOfTrust. Hero MotoCorp Limited Share Price Today, Live NSE Stock Price: Get the latest Hero MotoCorp Limited news, company updates, quotes, offers, annual financial. Welcome to the official account of Hero MotoCorp - your favourite & the world's largest two-wheeler manufacturer!

Hero Motocorp Ltd: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | NSE India S.E. Hero MotoCorp has been at the forefront of designing and developing technologically advanced motorcycles and scooters for customers around the world. Sign in › · your account. Search avtoelektrik48.ru Delivering to Mumbai - Update location ⌵. Hero MotoCorp home page. Hero MotoCorp. + Follow. Hero MotoCorp. likes · talking about this · were here. Welcome to the official account of Hero MotoCorp - your favourite & the. Hero Motocorp Share Price: Find the latest news on Hero Motocorp Stock Price. Get all the information on Hero Motocorp with historic price charts for NSE. Hero MotoCorp Limited is an Indian multinational motorcycle and scooter manufacturer headquartered in Delhi. It is one of the world's largest two-wheeler. HERO MOTOCORP avtoelektrik48.ru informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/08/,inter alia, to consider and approve the. Get to know more about the motorsport racing division of the world's largest two-wheeler manufacturer, Hero MotoCorp Ltd. Get Hero MotoCorp Ltd. share price today, stock analysis, stock rating, price valuation, performance, fundamentals, market cap, shareholding, and financial. Stock analysis for Hero MotoCorp Ltd (HMCL:Natl India) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Hero Moto Corp earlier also known as “Hero Honda” is one of India's first motorcycle manufacturers. The company started in as a Technological. Hero MotoCorp. likes · talking about this · were here. Welcome to the official account of Hero MotoCorp - your favourite & the. A collaboration between the world's most iconic motorcycle brand, Harley-Davidson and the world's largest two wheeler mobility company, Hero MotoCorp. The. Hero Motocorp share price Hero Motocorp is trading % upper at Rs 5, as compared to its last closing price. Hero Motocorp has been trading in the. Hero MotoCorp gets over Rs 17 cr tax notice from Delhi GST authorities · Hero MotoCorp to vroom on new launches and uptick in rural growth · Xtreme R's. Hero MotoCorp Ltd. engages in the manufacture of two wheeler. Its products include Karizma ZMR, Xtreme Sports, Achiever , New Glamour, Super Splendor, and. Hero MotoCorp Ltd (NSE:HEROMOTOCO) Intrinsic Valuation. Check if HEROMOTOCO is overvalued or undervalued under the bear, base, and bull scenarios of the. Discover historical prices for avtoelektrik48.ru stock on Yahoo Finance. View daily, weekly or monthly format back to when Hero MotoCorp Limited stock was. Hero Motocorp Ltd Live BSE Share Price today, Heromotoco latest news, announcements. Heromotoco financial results, Heromotoco shareholding. Get the latest Hero Motocorp Ltd (HEROMOTOCO) real-time quote, historical performance, charts, and other financial information to help you make more.