avtoelektrik48.ru Overview

Overview

Can You File Taxes For Free With Turbotax

Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free. Do you qualify to file for free? If you meet certain criteria, you may be eligible to file for free using one of the options below. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Start Free and File Free: The TaxAct Online Free Edition makes free federal filing available for those who qualify based on income and deductions. See if you. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can prepare. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Free File Fillable Forms are electronic federal tax forms, equivalent to a paper form. You should know how to prepare your own tax return using form. Want to file your taxes for free this year? Learn why you get more for free when you file with H&R Block Free Online vs. TurboTax Free. Do you qualify to file for free? If you meet certain criteria, you may be eligible to file for free using one of the options below. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Start Free and File Free: The TaxAct Online Free Edition makes free federal filing available for those who qualify based on income and deductions. See if you. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax. Some low income and military taxpayers may qualify for free tax preparation and e-filing through the IRS Free File Alliance web page; Most taxpayers can prepare. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Free File Fillable Forms are electronic federal tax forms, equivalent to a paper form. You should know how to prepare your own tax return using form.

If you google turbo tax free version and then click that and log in you will be able to file simple tax returns with turbo tax for free. If your adjusted gross income (AGI) was $79, or less, review each trusted partner's offer to make sure you qualify. Some offers include a free state tax. Rather than buying expensive software, you can electronically file your taxes TurboTax, Yes, No, No. Jackson Hewitt Technology Services, LLC, ProFiler, Yes. These Free File products are affiliated with the Free File Alliance (FFA), which partners with the IRS and state revenue agencies to offer free electronic tax. You may be able to file your federal and state taxes for free with TurboTax Free Edition. Roughly 37% of tax filers are eligible. See if you qualify. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. com allows you to efile your federal and Missouri state taxes for free if you meet the following requirements: Federal Adjusted Gross Income between. TurboTax tax software is perfect for students. Qualifying students get over $ back in education credits and deductions with TurboTax. See if you. If you want to take the stress out of tax filing season, however, it may be well worth the cost. *Click here for TurboTax offer details and disclosures. TurboTax Free costs $0. File your simple Canadian tax return for free with no hidden fees. media-value-prop-free. Roughly 37% of taxpayers are eligible. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If you. MilTax e-filing software is free for service members, eligible family members, survivors and recent veterans up to days from their separation or retirement. FREE Federal and MI (including City of Detroit) tax preparation and e-file. Age: 18 or older. Intuit TurboTax. FREE Federal and MI (including City of Detroit). FREE Federal and MI (including City of Detroit) tax preparation and e-file. Age: 18 or older. Intuit TurboTax. FREE Federal and MI (including City of Detroit). Simple tax returns are free. Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0. Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for less or free of. File your taxes for free. Choose the filing option that works best for you. File My Own Taxes. Have My Taxes Prepared for Me. Income limitations. Any income. E-file for free: A safe, convenient online filing Your return will not be rejected if you do not have a driver's license or state-issued identification. Switching is easy! Compare our free federal filing to other tax softwares'. No hidden fees, no forced upgrades. Simple or complex, we've got you covered.

Sdsu Ranking

Speaking of majors (and minors), undergrads at SDSU rush to underscore a handful of really stellar academic departments. Rankings & Lists. Best Value Colleges. Tuition and fees for in-state students are $5,, while tuition and fees for out-of-state students are $17, read more. avtoelektrik48.ru Rankings. Learn. San Diego State University ; World University Rankings ; Arts and Humanities + ; Business and Economics ; Clinical and Health SDSU ranked 43rd. CalTech ranked 47th. Congratulations to SDSU!!! Ranked higher than CalTech!! Quite a feat!!! Forbes America's Top Colleges. San Diego State University Ranking - CWUR World University Rankings ; Alumni Employment Rank, ; Quality of Faculty Rank, - ; Research Output Rank. Gamma Phi Beta - ΓΦΒ Sorority at San Diego State University - SDSU Ranking Roger Sep 13, AM I knew a girl from Gamma Phi Beta once. She had. #43 San Diego State University ; # In Public Colleges ; # In Research Universities ; # In The West. Discover latest world rank for San Diego State University and key information by years, areas and sectors. Check our website for more insight! San Diego State University is one of the top public universities in San Diego, United States. It is ranked # in QS World University Rankings Speaking of majors (and minors), undergrads at SDSU rush to underscore a handful of really stellar academic departments. Rankings & Lists. Best Value Colleges. Tuition and fees for in-state students are $5,, while tuition and fees for out-of-state students are $17, read more. avtoelektrik48.ru Rankings. Learn. San Diego State University ; World University Rankings ; Arts and Humanities + ; Business and Economics ; Clinical and Health SDSU ranked 43rd. CalTech ranked 47th. Congratulations to SDSU!!! Ranked higher than CalTech!! Quite a feat!!! Forbes America's Top Colleges. San Diego State University Ranking - CWUR World University Rankings ; Alumni Employment Rank, ; Quality of Faculty Rank, - ; Research Output Rank. Gamma Phi Beta - ΓΦΒ Sorority at San Diego State University - SDSU Ranking Roger Sep 13, AM I knew a girl from Gamma Phi Beta once. She had. #43 San Diego State University ; # In Public Colleges ; # In Research Universities ; # In The West. Discover latest world rank for San Diego State University and key information by years, areas and sectors. Check our website for more insight! San Diego State University is one of the top public universities in San Diego, United States. It is ranked # in QS World University Rankings

SDSU Global Campus online degree programs have been ranked among the top in the nation in several areas of study. San Diego State University (SDSU) is a public research university in San Diego, California, and is the largest and oldest higher education institution in. San Diego State University is ranked in QS World University Rankings by TopUniversities and has an overall score of stars. Sigma Chi - ΣΧ Fraternity at San Diego State University - SDSU Ranking Roger Sep 13, AM I think of passing by the Sigma Chi house at SDSU as. View San Diego State University rankings for and see where it ranks among top colleges in the U.S. San Diego State University Scientist and University Rankings - AD Scientific Index Learn more about studying at San Diego State University along with their tuition fees, ranking, eligibility, application, scholarships and more details. College Factual ranks SDSU No. 5 in Best Value Colleges for International Students. South Dakota State University ranked No. 5 in College Factual's Best Value. Academics. San Diego State University is a member of the California State University system. As such, it enjoys a strong academic reputation which is supported. SDSU achieved its highest-ever ranking among public universities, landing at No. 51 in the latest U.S. News & World Report's college. San Diego State University Rankings ; Best Hispanic-Serving Institutions in America. 10 of ; Best College Campuses in America. 15 of 1, ; Colleges with the. San Diego State University · History · Campus · Academics and student body · Rankings and reputation · Organization and administration · Athletics. San Diego State University ranking & overview including study areas, degrees, programs & courses, tuition, admission, acceptance rate. View San Diego State University ranking. Acceptance rate, tuition, gpa, requirements, majors, graduate programs, and courses can be found at avtoelektrik48.ru How SDSU Ranks in College Factual's Best Quality Rankings · Top Placement in Best Bachelor's Degree Colleges Ranking · Top Ranked Majors. Discover the academic excellence of San Diego State University with our latest QS, US News & World Rankings, alongside a comprehensive overview of our. NewsCenter | SDSU | SDSU Ranked No. 16 on Forbes' Top Public Colleges. avtoelektrik48.ru 5, Popular Rankings; Money's Methodology. MORE FROM MONEY. Credit; Insurance; Loans Out of the plus colleges that Money evaluated, SDSU scores well for. San Diego State University, San Diego Ranking from QS, THE & US NEWS ; Overall. # out of in Global Ranking. #36 out of in usa. # out of Explore the key indicators used to compile the ranking, as well as the top internationally ranked universities in San Diego San Diego State University.

What Are The Taxes On An Inherited Ira

How inherited IRAs and RMDs are taxed. If you inherit a traditional IRA, you're responsible for paying taxes on any RMDs at your regular income rate. If you don. The tax is based upon a beneficiary's right to receive money or property which was owned by the decedent at the date of death. This is in contrast to the. Distributions may be taken without being taxed (provided that the five-year holding period has been met), otherwise only earnings are taxable. You will not. However, you may have to pay income tax if you inherit an IRA/annuity, etc., which includes the decedent's pre-tax dollars. You should be notified by the estate. Inheritance Tax · 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; · percent on transfers to direct descendants. Roth IRAs are always taxable regardless of the decedent's Date Updated: 08/05/; What is the difference between probate assets and non-probate assets? For a newly retired couple with little other income coming in, a $,a-year distribution from an inherited IRA would be taxed at only the 12% marginal rate. The IRA will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time of death (for traditional IRAs). Roth IRAs are always taxable. Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary tax rate, regardless of whether the estate was. How inherited IRAs and RMDs are taxed. If you inherit a traditional IRA, you're responsible for paying taxes on any RMDs at your regular income rate. If you don. The tax is based upon a beneficiary's right to receive money or property which was owned by the decedent at the date of death. This is in contrast to the. Distributions may be taken without being taxed (provided that the five-year holding period has been met), otherwise only earnings are taxable. You will not. However, you may have to pay income tax if you inherit an IRA/annuity, etc., which includes the decedent's pre-tax dollars. You should be notified by the estate. Inheritance Tax · 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; · percent on transfers to direct descendants. Roth IRAs are always taxable regardless of the decedent's Date Updated: 08/05/; What is the difference between probate assets and non-probate assets? For a newly retired couple with little other income coming in, a $,a-year distribution from an inherited IRA would be taxed at only the 12% marginal rate. The IRA will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time of death (for traditional IRAs). Roth IRAs are always taxable. Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary tax rate, regardless of whether the estate was.

If you inherited an individual retirement account (IRA), you may have to include part of the inherited amount in your income. See "What If You Inherit an IRA?". You must file IRS Forms R and to report an inherited IRA and its distributions for tax purposes What to do with an inherited IRA. If you are a. Estate and Inheritance Tax Information · % tax on the clear value of property passing to a child or other lineal descendant, spouse, parent or grandparent. · 8. If a non-U.S. citizen beneficiary`s fiscal domicile within the meaning of Art. 4 of the US-Germany Income Tax Treaty was in Germany at the time of the. The beneficiary can deduct the estate tax paid on any part of a distribution that is income with respect to a decedent. If the executor moves the IRA directly into inherited IRAs for each of the beneficiary children, the beneficiaries would be responsible for paying the taxes. If. Key Takeaways · An inherited IRA, also known as a beneficiary IRA, is an account that you open when you inherit an IRA after the original owner dies. · You can'. The taxable amount is reported on Form , Page 1 and is not reported on Form Attach a separate Form to the return to report the basis of the. If the money has been in the Roth IRA for more than five years, the beneficiaries will not be required to pay any taxes on these distributions. It's important. For inherited Roth IRAs, the inherited assets generally have no immediate income tax impact and the withdrawals are tax-free as long as the original owner met. Traditional beneficiary IRA. Any distributions are generally taxable, but the 10% penalty for early withdrawals before age 59 1/2 doesn't apply. In addition. Due to the original SECURE Act, most beneficiaries can no longer “stretch” distributions over their lifetimes. Instead, many non-spouse beneficiaries who. Withdrawals from an inherited traditional IRA are taxed as ordinary income. Typically, Roth IRA distributions aren't taxable, except in cases when the original. If the executor moves the IRA directly into inherited IRAs for each of the beneficiary children, the beneficiaries would be responsible for paying the taxes. If. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year, starting at age 73* or after inheriting any IRA account for. federal income tax, but not state or local income tax; any federal estate, gift, and excise taxes and any state estate or inheritance taxes. Using the money. What are the tax features? Qualified distributions from an inherited Roth IRA are not taxed. However, distributions from other types of inherited IRAs are. Rolling the assets into your own IRA works best if you're past age 59 1/2 as a 10% tax penalty may apply for withdrawals taken before age 59 1/2. Required. Roth IRAs are always taxable regardless of the decedent's Date Updated: 08/05/; What is the difference between probate assets and non-probate assets?

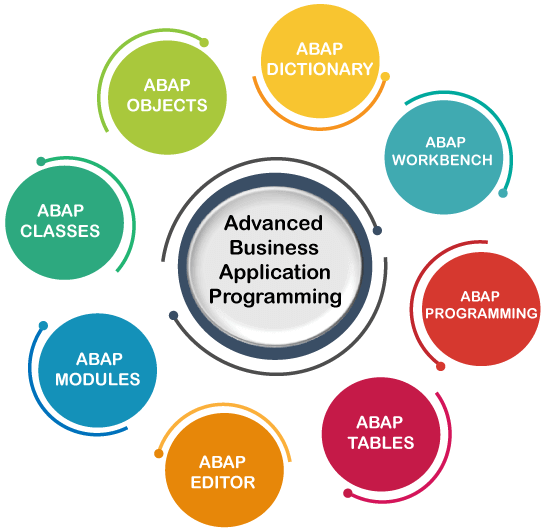

Learn Sap Abap

SAP's official website · OpenSAP · YouTube tutorials · SAP Community forums · Udemy (occasionally has free or discounted courses) · Coursera . SAP ABAP Course: Online Training ✔️ Get hours of live online session ✔️ Experienced faculty ✔️ Training material ✔️ Case-studies ✔️ 1-year Gold membership. Get started with ABAP! Learn how to develop in on-premise and cloud systems and explore more learning journeys to increase your SAP programming knowledge. Learning SAP ABAP? Check out these best online SAP ABAP courses and tutorials recommended by the programming community. Pick the tutorial as per your. Course Description. SAP ABAP Online Training is intended for individuals looking to advance in the field of software development and master the fundamentals of. ABAP Language Versions. Each ABAP program has the program attribute "ABAP language version", which is defined internally by a version ID. The version of a. This tutorial is designed for those who want to learn the basics of SAP ABAP and advance in the field of software development. In this comprehensive guide, we'll delve into the fundamentals of SAP ABAP, its benefits, job opportunities, and future scope. Learn SAP ABAP from a top-rated Udemy instructor. Udemy offers basic to advanced SAP ABAP courses to help you write and debug SAP ABAP code, and prepare for. SAP's official website · OpenSAP · YouTube tutorials · SAP Community forums · Udemy (occasionally has free or discounted courses) · Coursera . SAP ABAP Course: Online Training ✔️ Get hours of live online session ✔️ Experienced faculty ✔️ Training material ✔️ Case-studies ✔️ 1-year Gold membership. Get started with ABAP! Learn how to develop in on-premise and cloud systems and explore more learning journeys to increase your SAP programming knowledge. Learning SAP ABAP? Check out these best online SAP ABAP courses and tutorials recommended by the programming community. Pick the tutorial as per your. Course Description. SAP ABAP Online Training is intended for individuals looking to advance in the field of software development and master the fundamentals of. ABAP Language Versions. Each ABAP program has the program attribute "ABAP language version", which is defined internally by a version ID. The version of a. This tutorial is designed for those who want to learn the basics of SAP ABAP and advance in the field of software development. In this comprehensive guide, we'll delve into the fundamentals of SAP ABAP, its benefits, job opportunities, and future scope. Learn SAP ABAP from a top-rated Udemy instructor. Udemy offers basic to advanced SAP ABAP courses to help you write and debug SAP ABAP code, and prepare for.

How to create ALV with OOPS? · How to create ALV with Events? · SAP ABAP Online Training | Advanced ABAP Programming for SAP - Part 2 · Learn SAP. ABAP is an easy-to-learn programming language offering object-oriented and procedural programming concepts. Developers can effortlessly use ABAP language to. ABAP Programming for SAP. ABAP (Advanced Business Application Programming) is the name of SAP's proprietary, fourth-generation programming language. It was. What is ABAP Data Dictionary? · What are Data Elements and Domains? · How to create a Domain? · How to create a Data Element? · How to create a SAP Table? · Maintain. Begin your abap programming learning journey in the SAP BTP environment, learn how to develop your first RESTful ABAP app, and join community discussions. IGROW SOFT SOLUTIONS is the presents the Best SAP ABAP training in Hyderabad. Moreover, helping students to enhance their awareness and skills in various SAP. This online SAP ABAP training is designed to ensure that you learn and master the concepts of being an SAP ABAP Developer and Consultant. Through this, you'll. SAP-ABAP · Entering into SAP & Learning ABAP- Day 1 · Videos. SAP ABAP Online Training SAP ABAP Online Training Course from Besant Technologies helps candidates to provide an in-depth understanding of the basics of the. SAP ABAP (Programming) · 45 Hours of Instrucot Led Live Training Sessions · Online Access to Recorded videos for 1 Year · 2 Months of server access to do practice. Whether you're new to programming or just new to ABAP, this SAP ABAP course is your guide to rapid, real-world enterprise software development. With this learning journey, explore ABAP from a beginner's viewpoint all the way through advanced topics. Featuring videos, blog posts, and more. Courses can be used either for a first introduction (but this is costly for such a use) or for extremely advanced subject (better). SAP is a full environment. Collection of free SAP ABAP Courses. These free sap abap courses are collected from MOOCs and online education providers such as Udemy, Coursera, Edx. SAP ABAP on HANA provides developers with tools and techniques to optimize existing ABAP code to run more efficiently on the HANA platform. It also allows for. You could look at the SAP Education and Training Course Guides to see the recommended path they go through for learning ABAP. SAP ABAP stands for “Advanced Business Application Programming,” allowing SAP customers to build custom apps and programs using this programming language. ABAP Courses and Certifications ; SAP ABAP Programming For Beginners - Online Training · ratings at Udemy · 13 hours 19 minutes ; Learn SAP ABAP Objects -. This article by Multisoft Virtual Academy delves into the essentials of SAP ABAP training, covering its importance, what the training involves, how to choose. ABAP is the fourth-generation programming language and technical module of SAP, which is used to develop the applications related to SAP.